Al Bai Bithaman Ajil Concept

Why are you still asking me about bba and bai al inah.

Al bai bithaman ajil concept. Academia edu is a platform for academics to share research papers. Property land motor vehicle consumer goods shares overdraft facility education financing evidences package etc. Property land motor vehicle consumer goods shares overdraft facility education financing package etc. Bai bithaman ajil ijarah istisna dan lain lain.

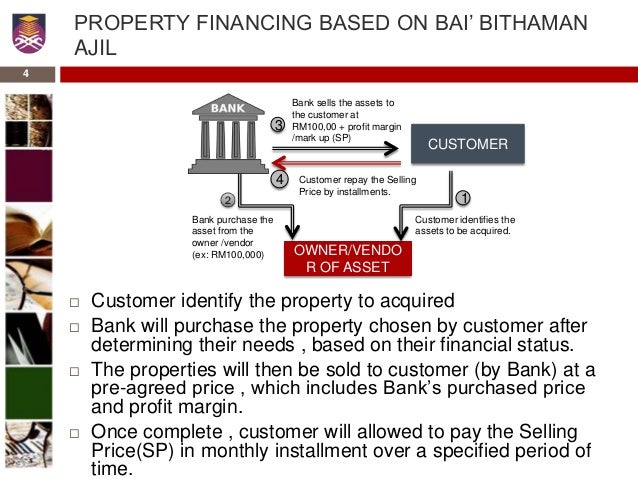

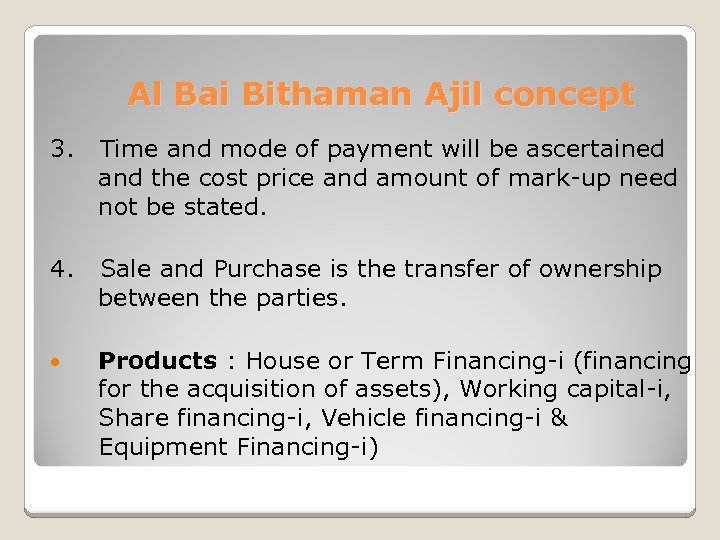

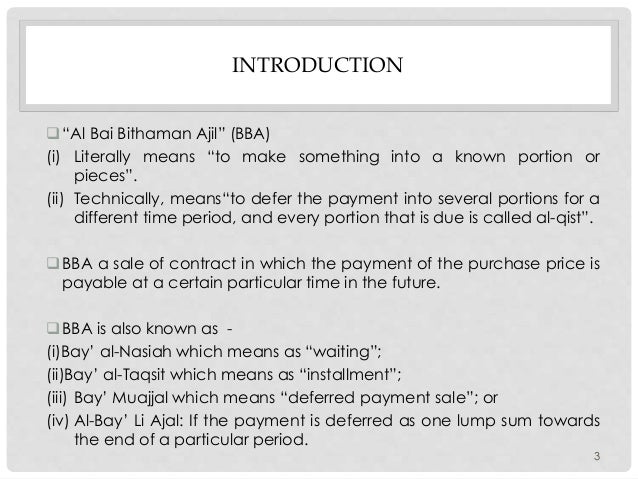

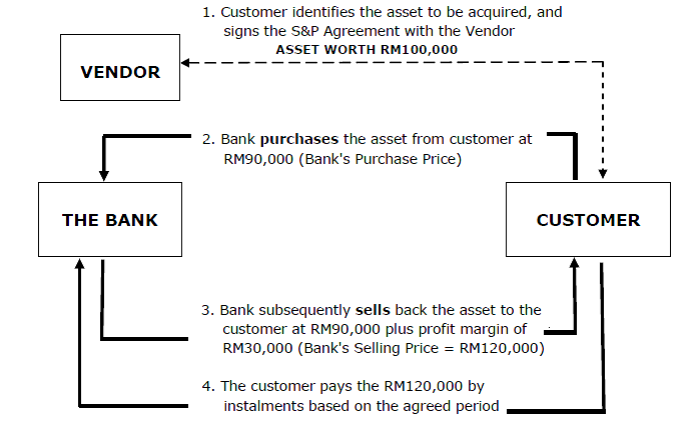

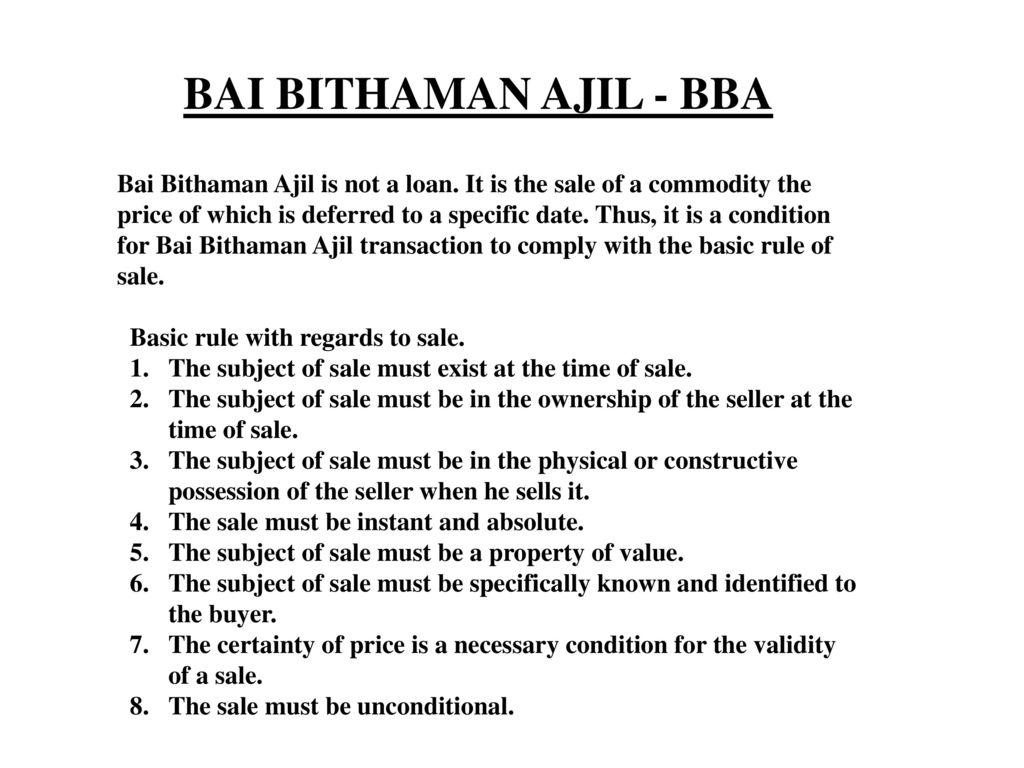

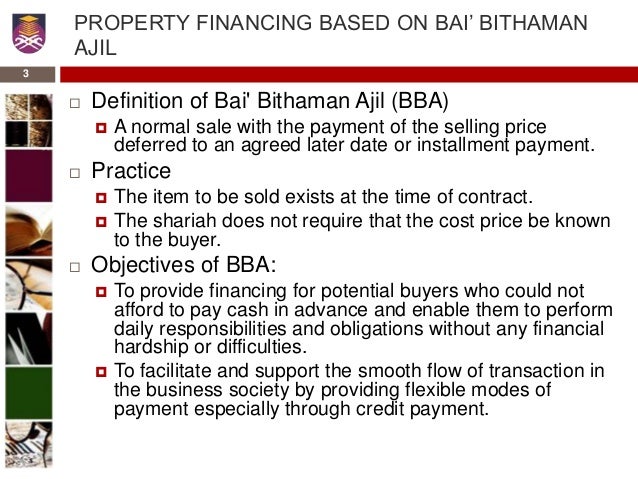

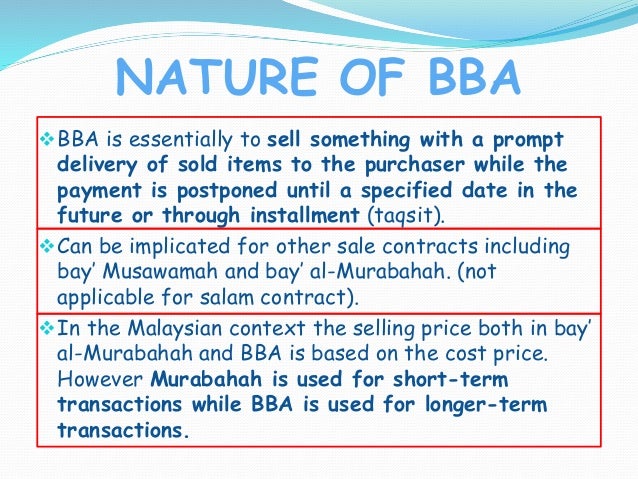

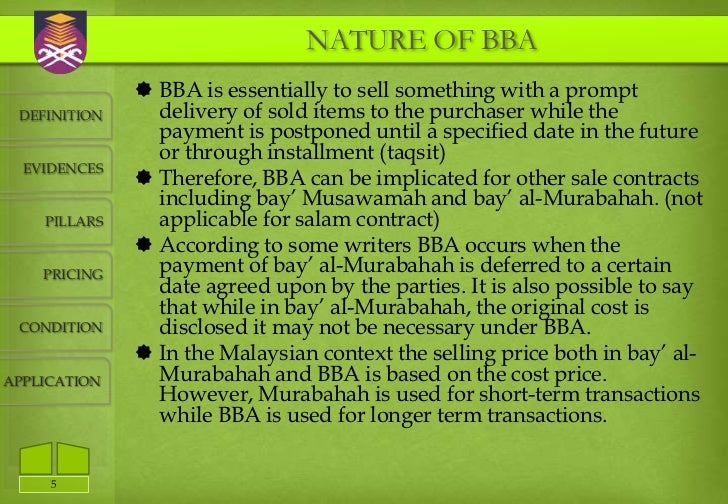

Equipment or goods requested by the client are bought by the bank which subsequently sells the goods to the client for an agreed price including a mark up profit for the bank. However in layman term it s just a purchase of good on credit. Bai al dayn refers to a contract of debt trading created from shariah compliant business activities. A contract that refers to the sale and purchase transaction for the financing of assets on a deferred and an installment basis with a pre agreed payment period.

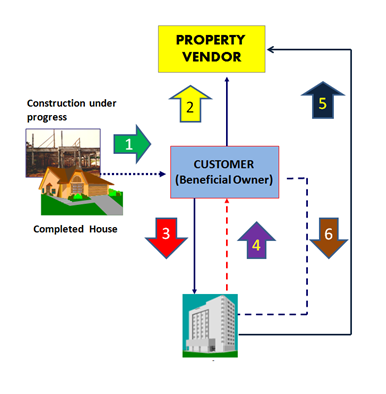

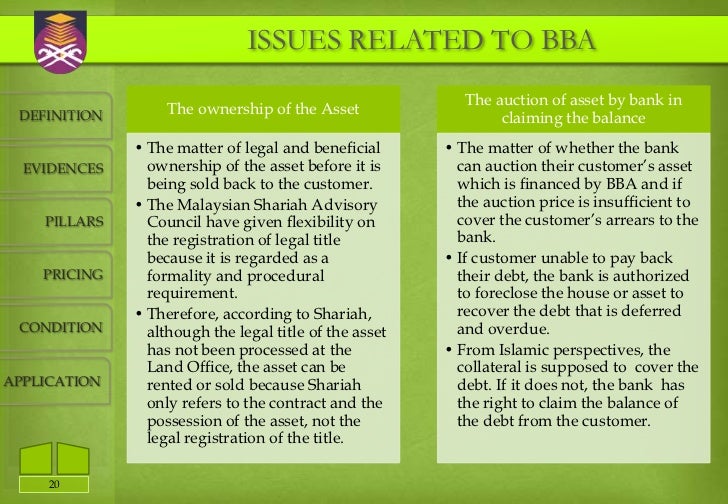

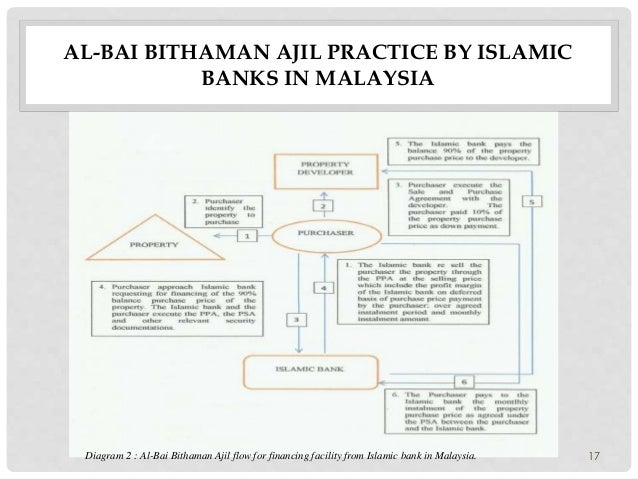

The sale of goods on a deferred payment basis. It remains a mystery when people ask me why malaysia continues to offer bai bithaman ajil bba and bai al inah products as according to them these structures are based on elements of hilah trickery. Home financing is the most popular facility granted pillars under the concept of bai bithaman ajil bba either to purchase existing completed houses build or construct new house on customer s land even as a refinancing pricing facility. Home financing is the most popular facility granted under the concept of bai bithaman ajil bba either to purchase existing completed houses build or construct new house on customers land even as a refinancing facility.

This particular contract has become exceedingly popular in the islamic banking context as will be explored later. A deferred payment sale where the payment is made in a single installment is called bai bithaman ajil. It is a mystery because starting from 2012 2013 period the instructions on interconditionality issued by bnm to islamic financial. This type of transaction is best referred to as deferred payment sale.

The dual banking system in malaysia is expected to put islamic banks at a disadvantage due to the latter s over dependency on fixed rate asset financing such as al bay bithaman ajil and murabahah when interest rates are rising rational product choice among non muslim customers nmc is expected to produce a shifting effect that may frustrate deposit mobilization and at the same time.