Difference Between Director Fee And Director Remuneration Malaysia

There are significant differences between the two.

Difference between director fee and director remuneration malaysia. In contrast payment of director s fee does not require the company to contribute cpf and sdl. Directors may be classified as non executive directors or executive directors. I use intuit payroll for that. Epf socso payout on director is tax deductible as company expense.

I enter my hours worked sometimes add in some bonus and intuit software does the rest. Typically the director s fee has to be approved during agm and can be payable in arrears or in advance. A primer on directors fees in malaysia. So it gives flexibility in term of amount when there is a profit or based on company profit level.

Difference between director drawing salary vs director fee director fee once in a year so you only declare when there is profit. I am a director of my corporation also perform functions as an employee and for that i pay myself a salary. Salary paid at a commercial rate for the work done. Remuneration the whole lot added together with any other biks.

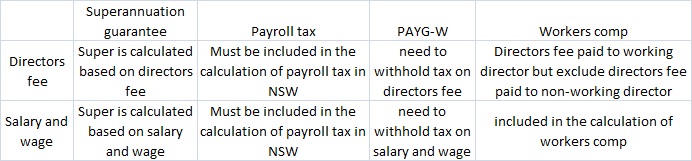

The board of directors in turn will determine how those fee payments are split up among the directors including the general director of the company. Year 2009 onward with reference to new act para 25 2a of income tax act 1967 director s fee or bonus is receivable in respect of the whole or parts of the relevant period the fee or bonus when receive in relevant period shall be treated as gross income in the year of receipt. The table below compares the difference between directors fee and salary and wage in the calculation of super payroll tax payg w and workers compensation. This study has developed a special tool known as the directors remuneration reporting scorecard drrs which is based on the requirements of the malaysian code on corporate governance and international best practices such as oecd icgn sec of us.

On the other hand director s remuneration meaning the salaries and bonuses paid out to directors is part of the directors employment contract signed with the company. For the purpose of the question loosely defining the terms fee lump sum. What is the difference between directors fees and executive remuneration. What is the hmrc position.

12 the disclosure must include the amount in each component of the remuneration e g. Director salary fixed drawing every month. Directors fees salaries percentages. The wider community and the media often seem to be confused about directors fees and executive remuneration.

This is because director s fee is deemed as a payment for the contract for service and is not consider as an employee s remuneration. Is there any distinction between director s fee vs salary. Resolution the payment of any fee will be a debt due by the director to the company 6.