Difference Between Islamic Banking And Conventional Banking In Urdu

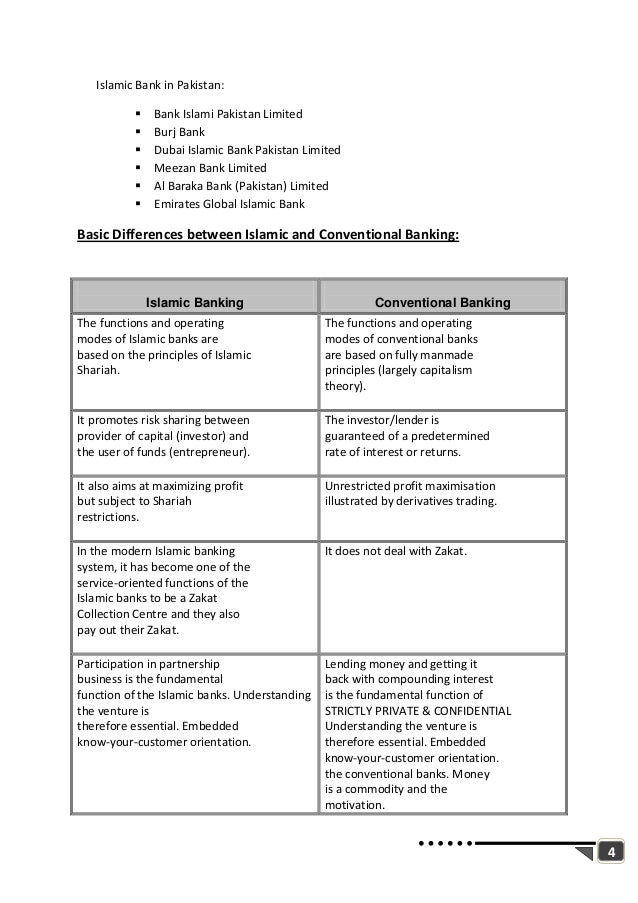

Let us first understand the major difference between islamic banking and conventional banking system.

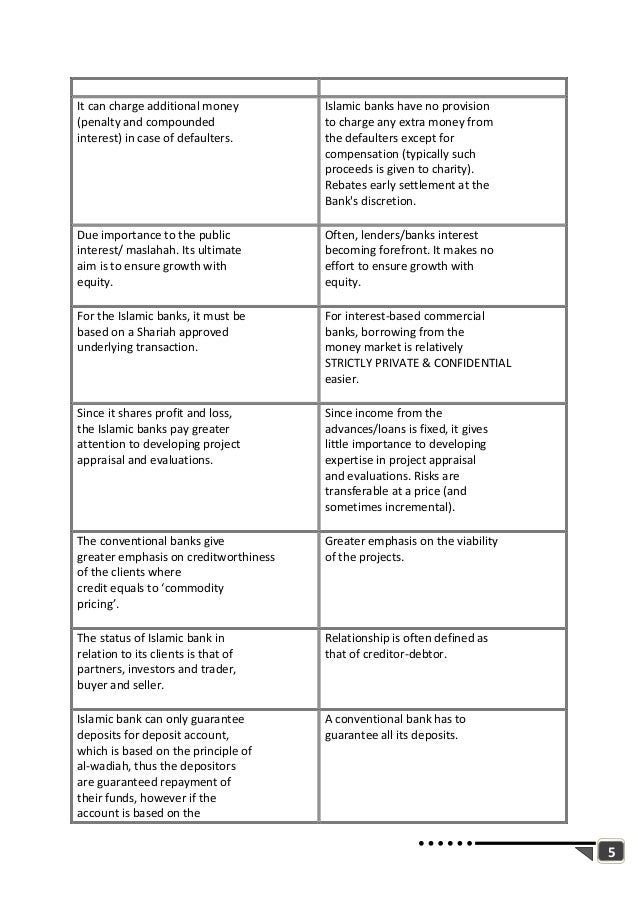

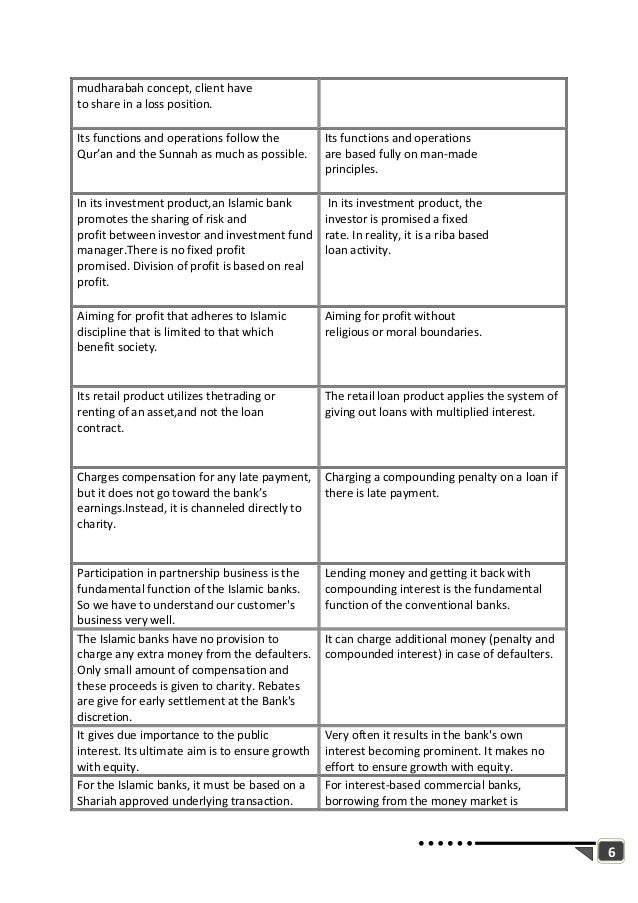

Difference between islamic banking and conventional banking in urdu. An islamic loan is based on shariah laws the islamic religious law as stated in the quran hadith and sunnah. The bank s interest comes before the client s as opposed to the islamic banking system. Conventional bank treats money as a commodity and lend it against interest as its compensation. Profit on exchange of goods services is the basis for earning.

Interest in completely prohibited in islamic banking. The key difference is that islamic banking is based on shariah foundation. Ust hj zaharuddin hj abd rahman one must refrain from making a direct comparison between islamic banking and conventional banking apple to apple comparison. Islamic banking is an ethical banking system and its practices are based on islamic shariah laws.

Differences between islamic banking and conventional banking offerings deposit liabilities casa term deposit conventional banks accept deposits on the basis of loan for all types of deposit accounts including term deposit savings and currents accounts. Considering the performance of islamic and conventional banks during the recent crisis we find little differences except that islamic banks increased their liquidity holdings in the run. The numerical data is shown in table 1 the difference between the roe is increasing with the passage of time and it was only 1 73 and 23 09 for the conventional banks in the last year but 11 16 and 113 4 for the islamic bank. Specifically in countries where the market share of islamic banks is higher conventional banks tend to be more cost effective but less stable.

Major differences between islamic and conventional banking. Thus all dealing transaction business approach product. Interest based returns are provided for the. Fundamentally the difference between islamic banking and conventional banking is that the idea fairness to the clients is theoretically focused on the idea of islamic banking itself.

Islamic banks recognize loan as non commercial and exclude it from the domain of commercial transactions. The word contract comes from arabic al aqd which etymologically means engagement agreement and agreement al ittifaq. Return on equity is the second measure of profitability which is higher for islamic bank for the year 2015. Unlike conventional loans where money is seen as a commodity there is no money loaned to the borrower as the bank will purchase the item for the borrower and sell it to them at a higher price.

Conventional banks aim to maximize returns and minimize risk. Any loan given by islamic banks must be interest free. Money is a product besides medium of exchange and store of value. Real asset is a product money is just a medium of exchange.

In conventional banks almost all the financing and deposit side products are loan based. Time value is the basis for charging interest on capital.