Difference Between Islamic Banking And Conventional Banking Slideshare

Aims education islamic banking vs conventional banking let us first understand the islamic banking and conventional banking system.

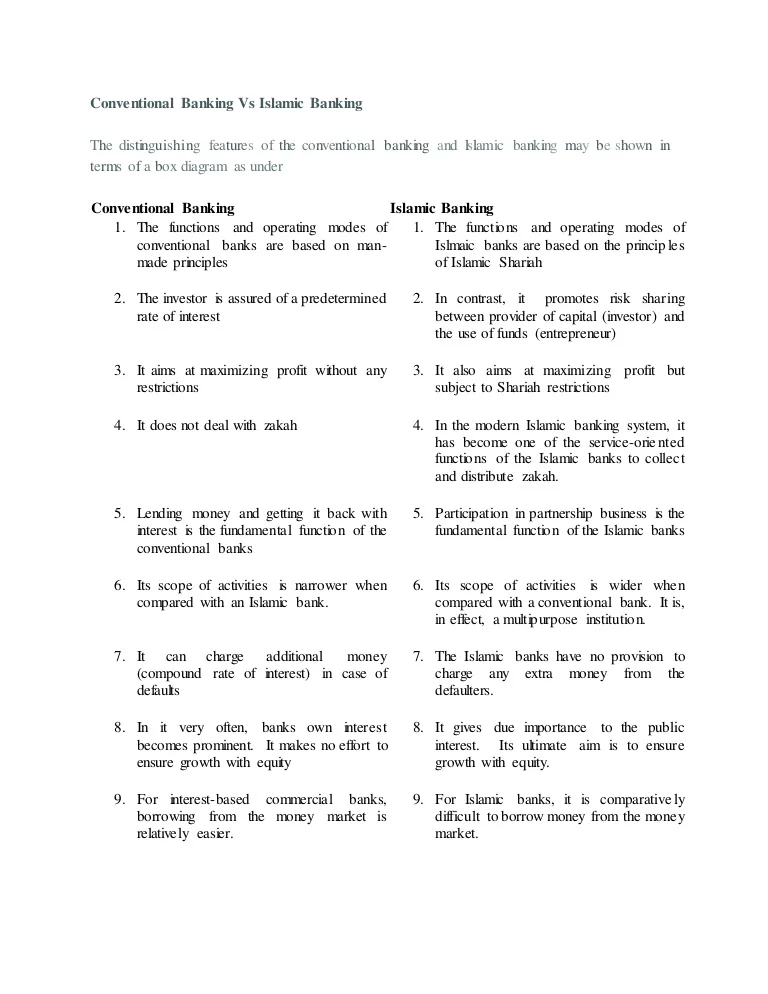

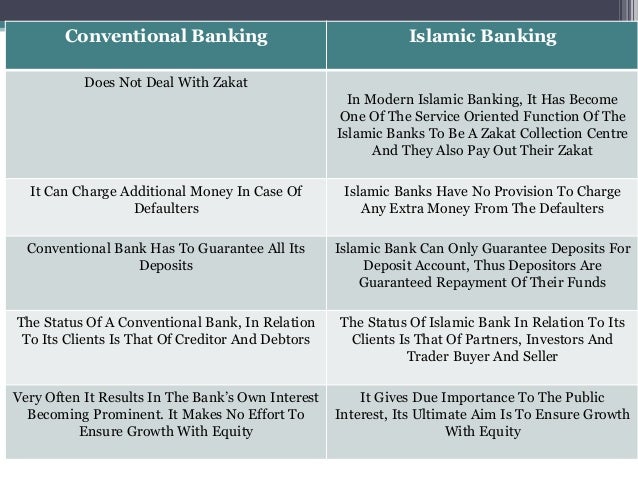

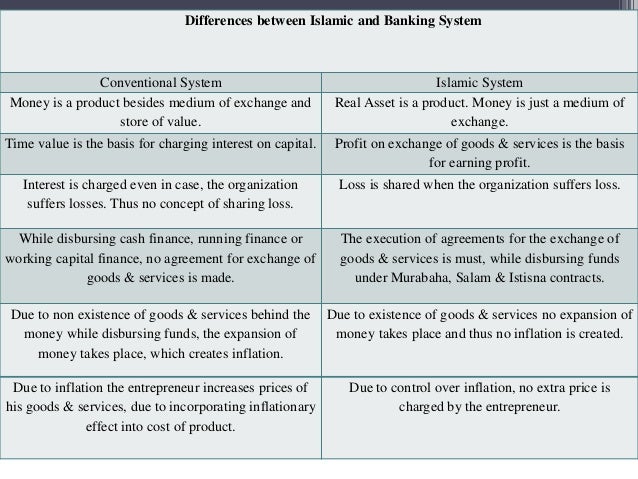

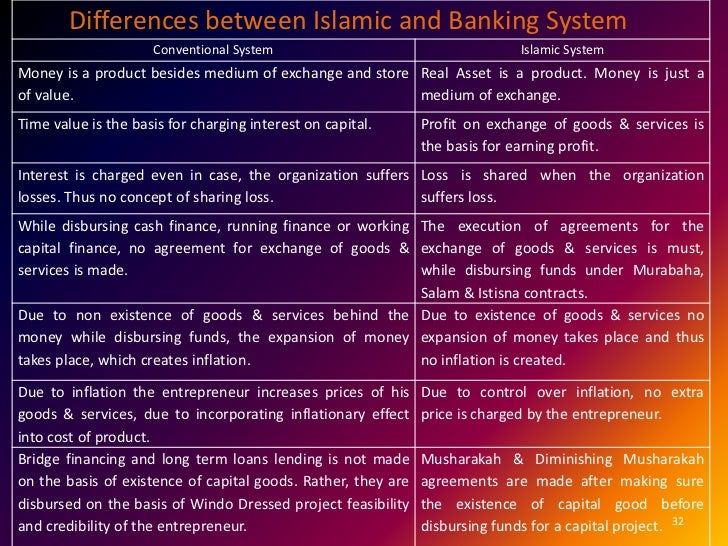

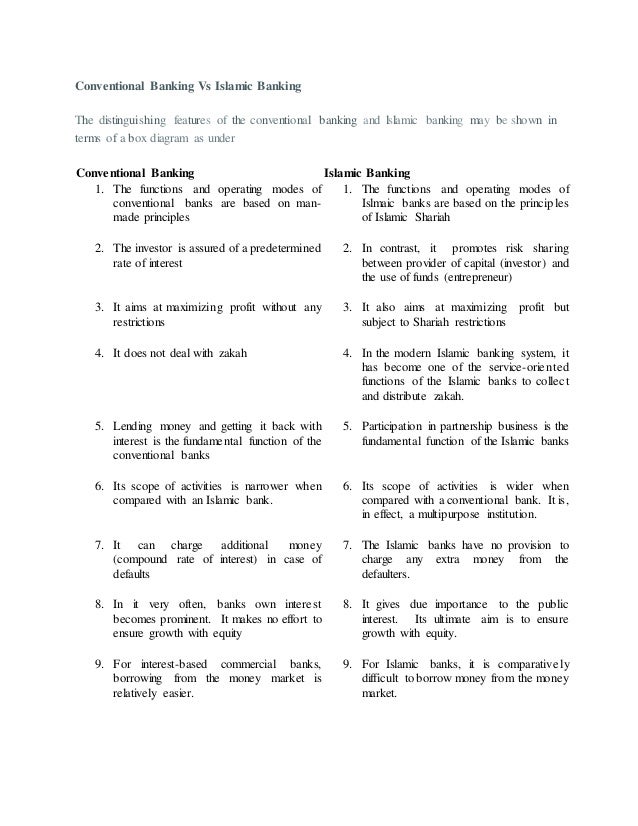

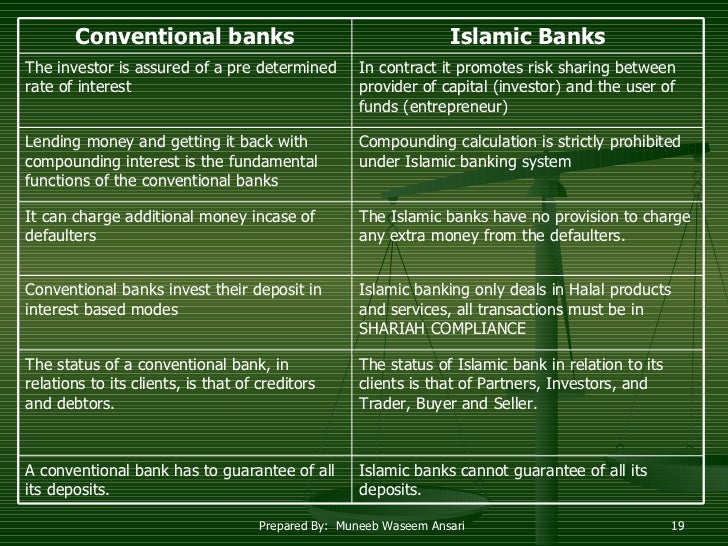

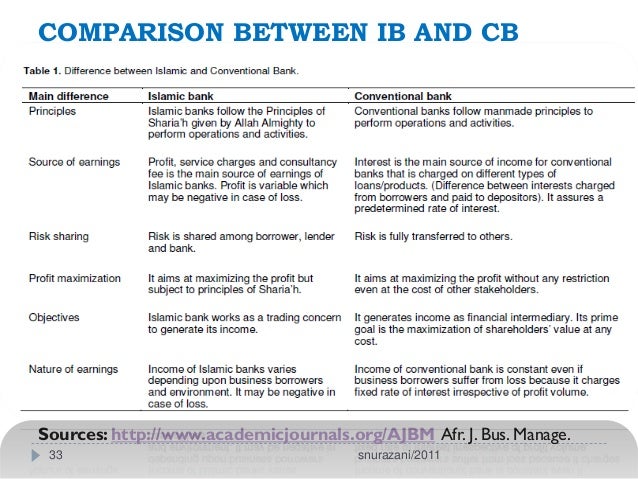

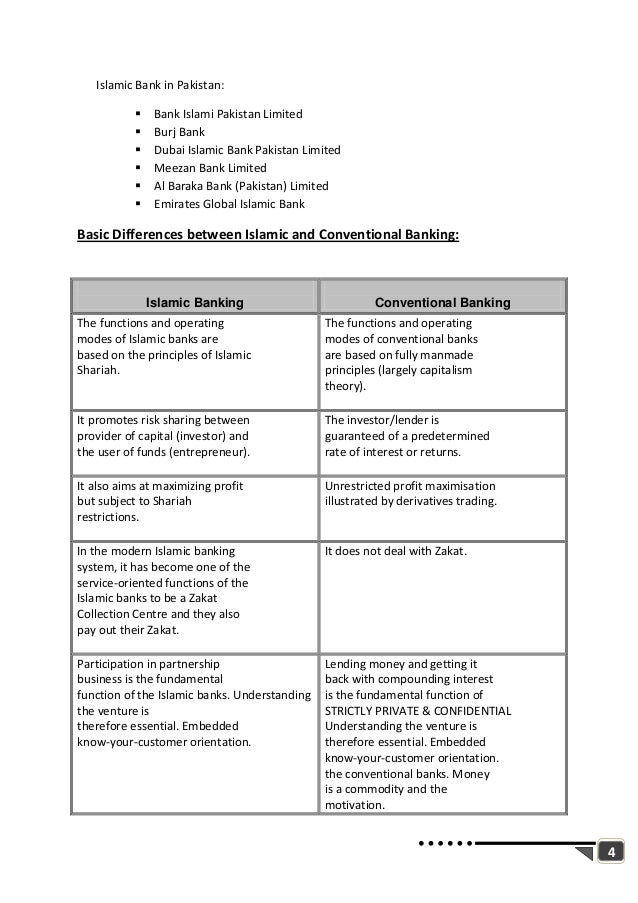

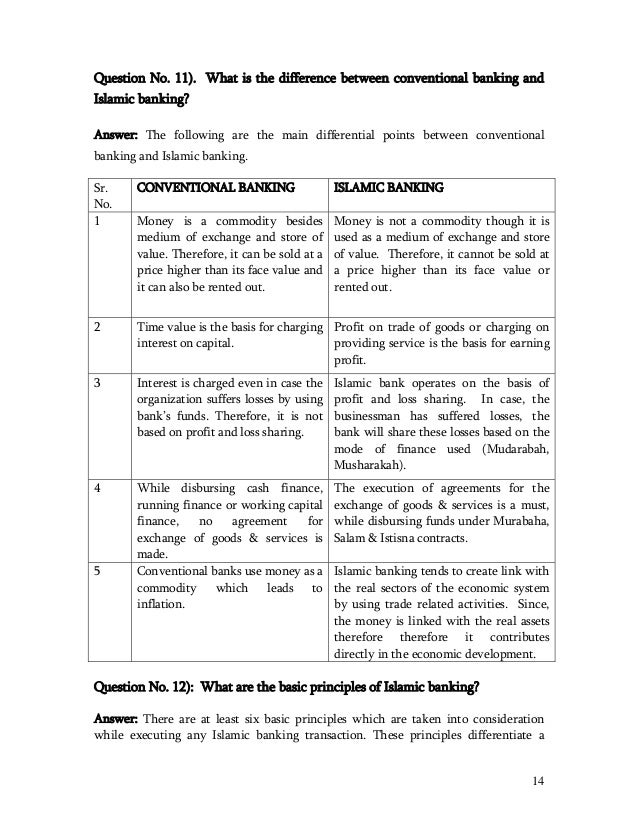

Difference between islamic banking and conventional banking slideshare. The difference between conventional which called western banking and islamic banking are following. The functions and working modes of conventional banks are based fully manmade principles. Interest in completely prohibited in islamic banking. Academy for international modern studies aims uk.

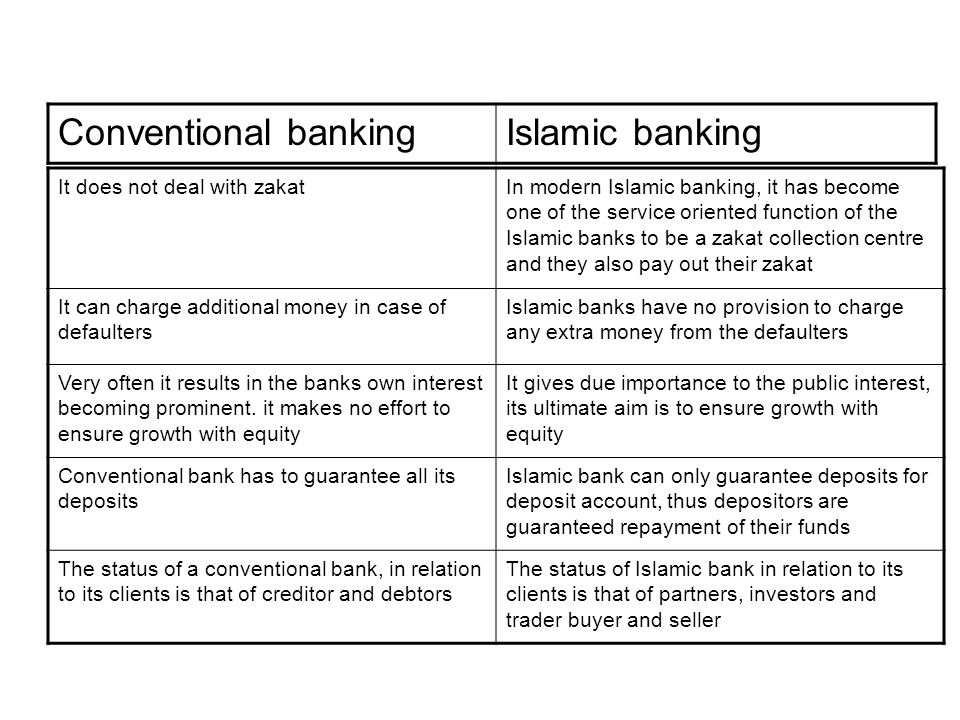

In conventional bank no such framework is present. Islamic banking is an ethical banking system and its practices are based on islamic shariah laws. Academy for international modern studies aims uk. Fundamentally the difference between islamic banking and conventional banking is that the idea fairness to the clients is theoretically focused on the idea of islamic banking itself.

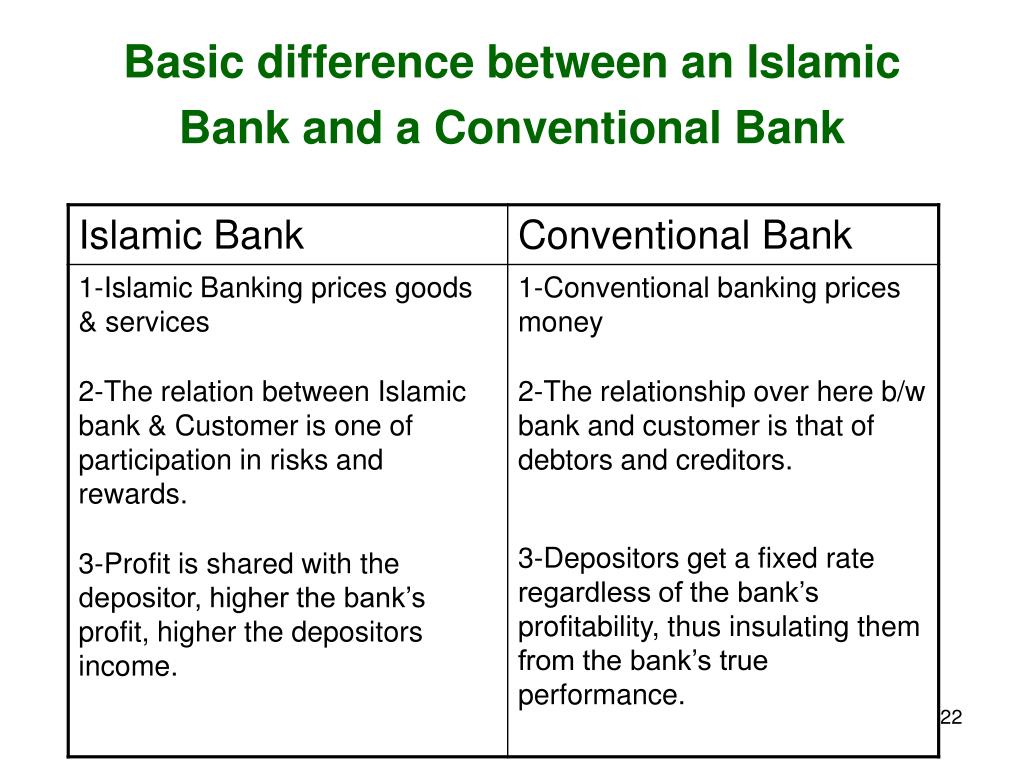

Difference between islamic and conventional current account. Although islamic banking has many products similar to those offered by conventional banking the two entities differ conceptually. Berbagai data terkait difference between islamic banking and conventional banking slideshare. Conventional banks aim to maximize returns and minimize risk.

Islamic banks have strong shariah governing framework in terms of shariah board who approves the transactions and products in the light of the shariah rulings. Let us first understand the major difference between islamic banking and conventional banking system. The functions and operating modes of islamic banks are based on the rule of islamic shariah. Difference between islamic banking and conventional banking.

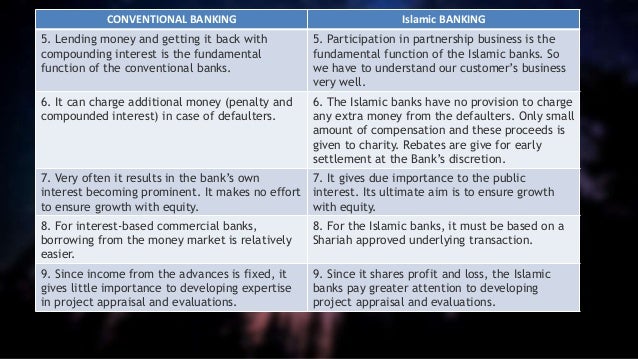

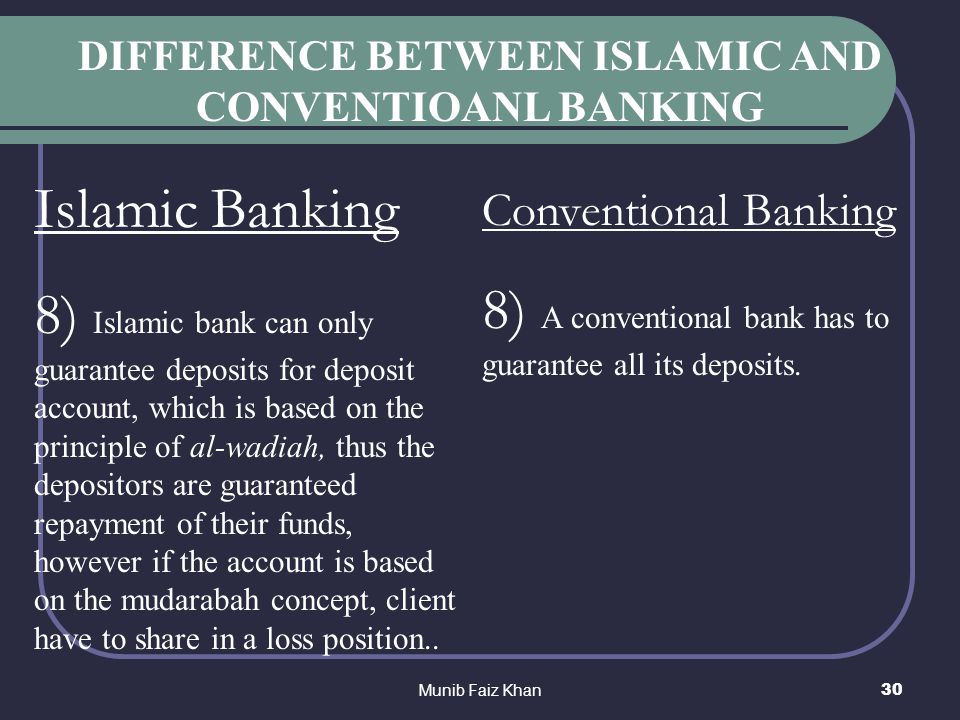

Conventional banking islamic banking. 5 the difference between islamic banks and conventional banks on the liability side 36 the current account of conventional banks and islamic banks are identical to each other 36 the difference in the other accounts 37 an islamic bank cannot fix the profit in advance 39 it is not correct to declare an individuals fault a fault of the system 40 the method of acquiring the correct facts 40 some. One of the islamic bank business model is based on trade thus it needs to actively participate in trade and production process and activities. Unlike conventional loans where money is seen as a commodity there is no money loaned to the borrower as the bank will purchase the item for the borrower and sell it to them at a higher price.

The bank s interest comes before the client s as opposed to the islamic banking system. The future of islam. Interest based returns are provided for the.