Difference Between Islamic Banking And Conventional Banking

Conventional banking islamic banking.

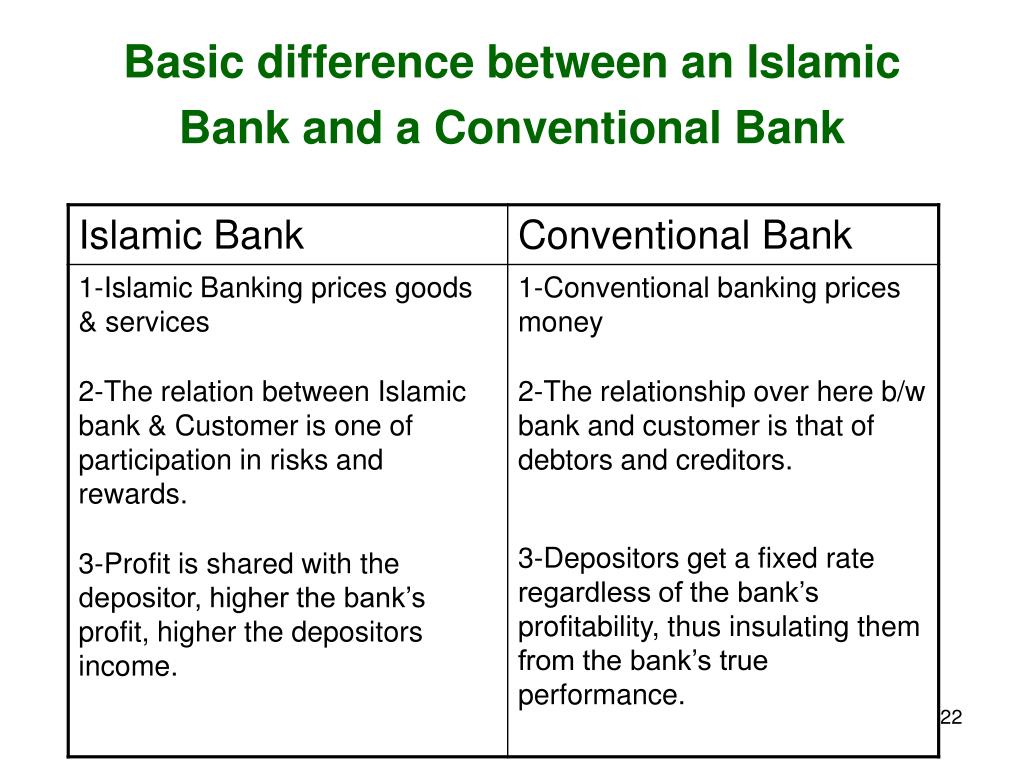

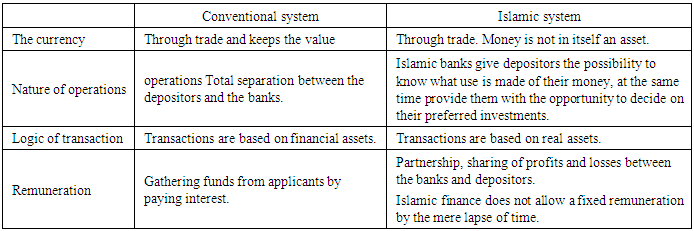

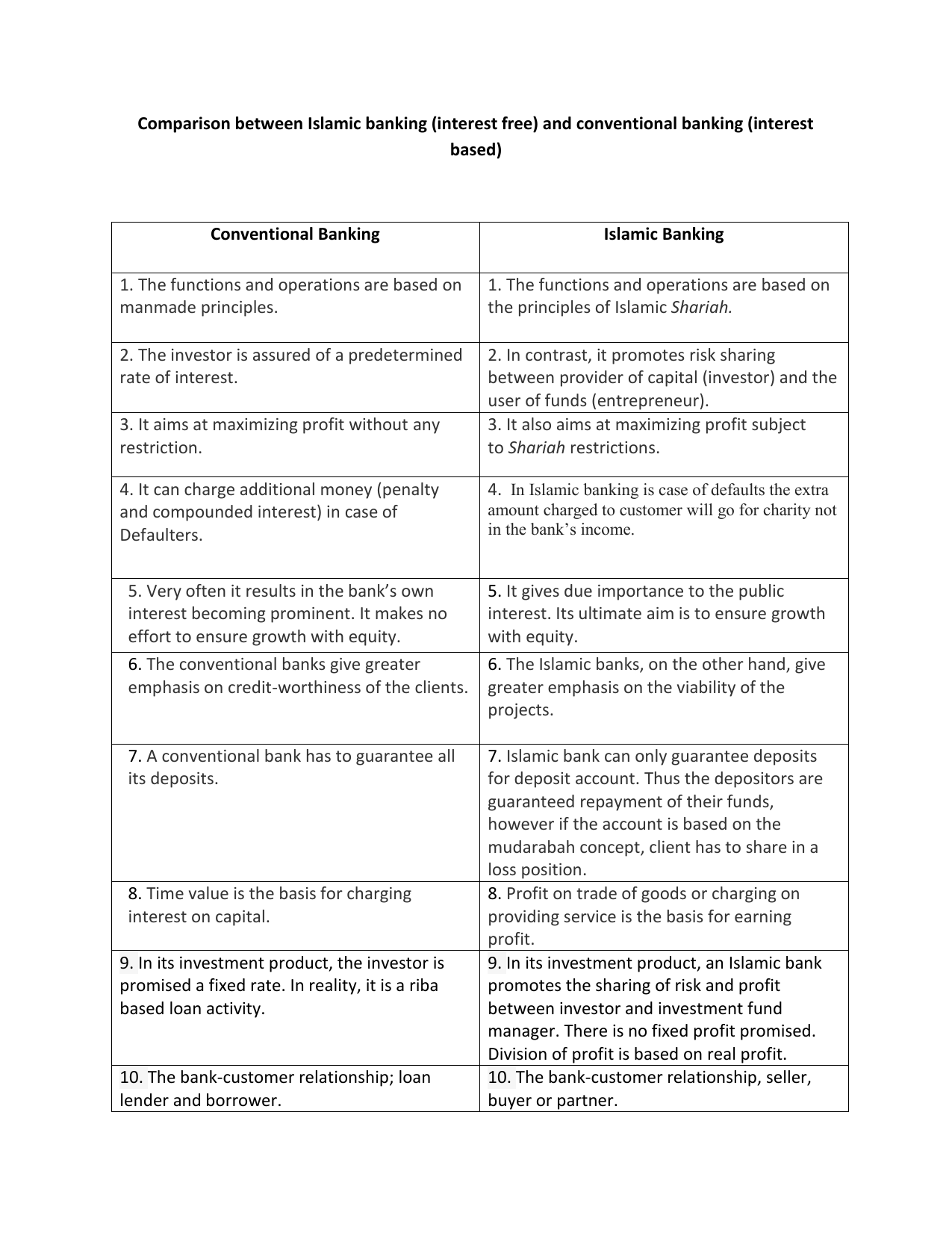

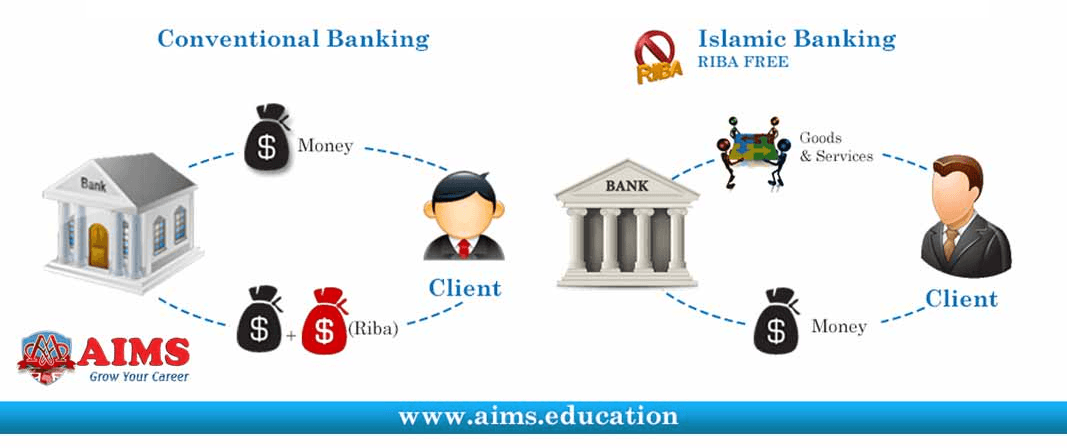

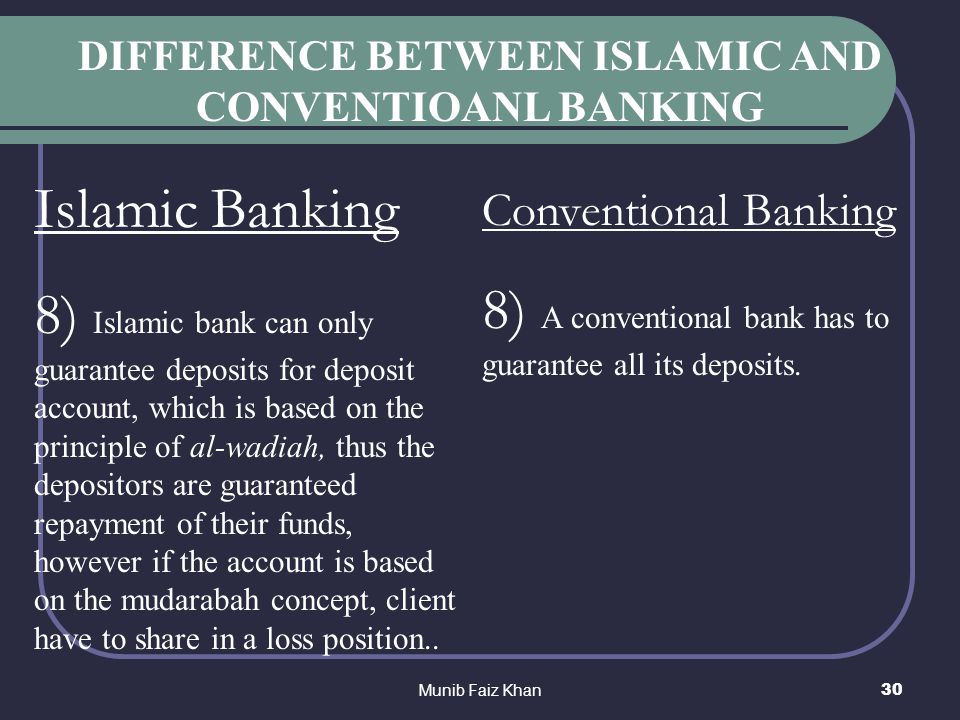

Difference between islamic banking and conventional banking. Interest in completely prohibited in islamic banking. Unlike conventional loans where money is seen as a commodity there is no money loaned to the borrower as the bank will purchase the item for the borrower and sell it to them at a higher price. Let us first understand the major difference between islamic banking and conventional banking system. The functions and operating modes of islamic banks are based on the rule of islamic shariah.

This has become all the more important since an increasing number of local and foreign banks in the uae are either starting their own separate. The two main forms of islamic finance are bank finance and issuing islamic securities called sukuk. The functions and working modes of conventional banks are based fully manmade principles. Major differences between islamic and conventional banking.

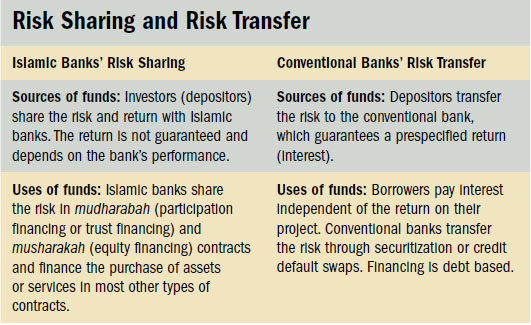

Conventional banks aim to maximize returns and minimize risk. In this step we examine what these differences can teach us about risk and risk management in conventional banking and financial markets. Interest based returns are provided for the. Conventional banks are profit making organizations that generally aren t based on religious principles.

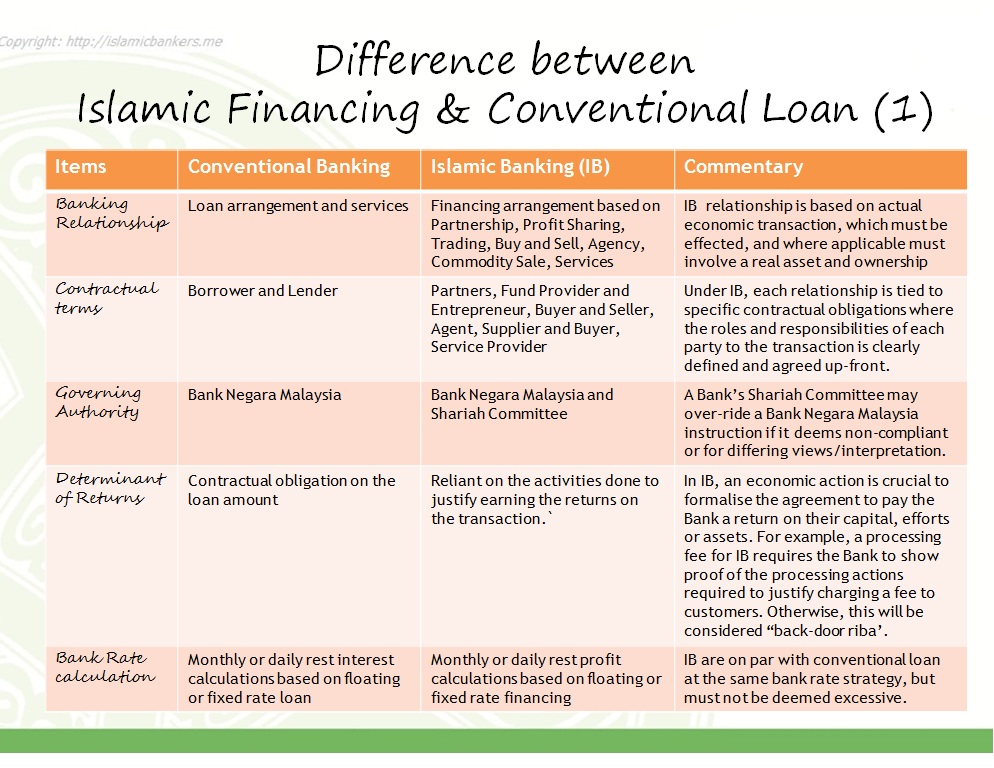

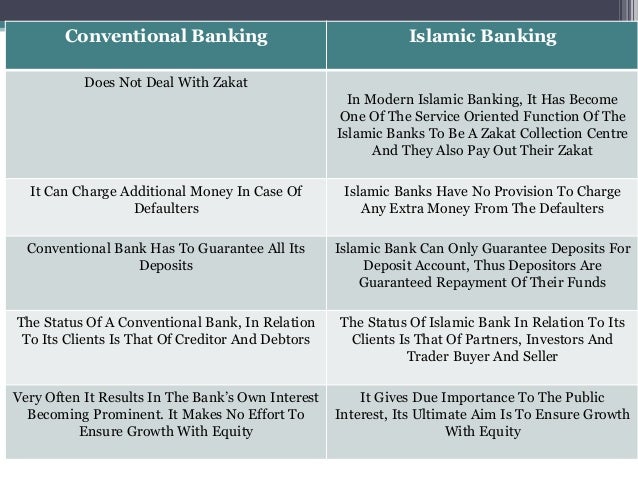

The difference between conventional which called western banking and islamic banking are following. That difference is just one of many ways that the fundamentals of islamic banking differ from those of conventional commercial banking. Differences between islamic banking and conventional banking offerings deposit liabilities casa term deposit conventional banks accept deposits on the basis of loan for all types of deposit accounts including term deposit savings and currents accounts. The basic purpose for establishing an islamic bank is to promote and encourage islamic principles.

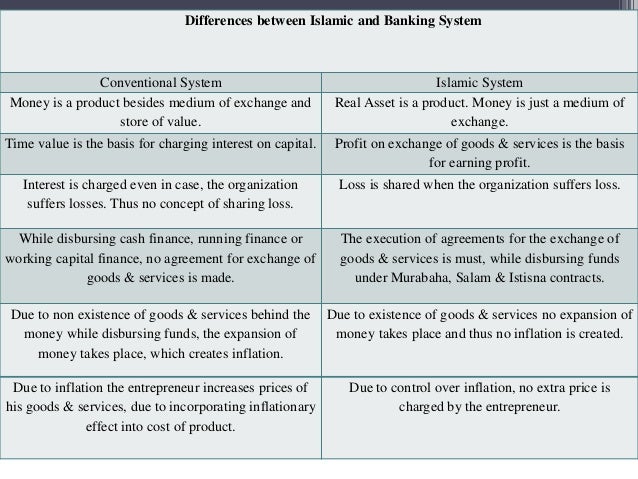

The main difference between islamic and conventional finance is the treatment of risk and how risk is shared. Islamic banking is an ethical banking system and its practices are based on islamic shariah laws. Profit on exchange of goods services is the basis for earning. Real asset is a product money is just a medium of exchange.

Fundamentally the difference between islamic banking and conventional banking is that the idea fairness to the clients is theoretically focused on the idea of islamic banking itself. The islamic bank s financing is structured as a purchase and resale of real assets such as car house commodity or stock instead of a loan. Difference between islamic and conventional current account. Time value is the basis for charging interest on capital.

Although islamic banking has many products similar to those offered by conventional banking the two entities differ conceptually. The bank s interest comes before the client s as opposed to the islamic banking system.