Mfrs 138 Intangible Assets Recognition Criteria

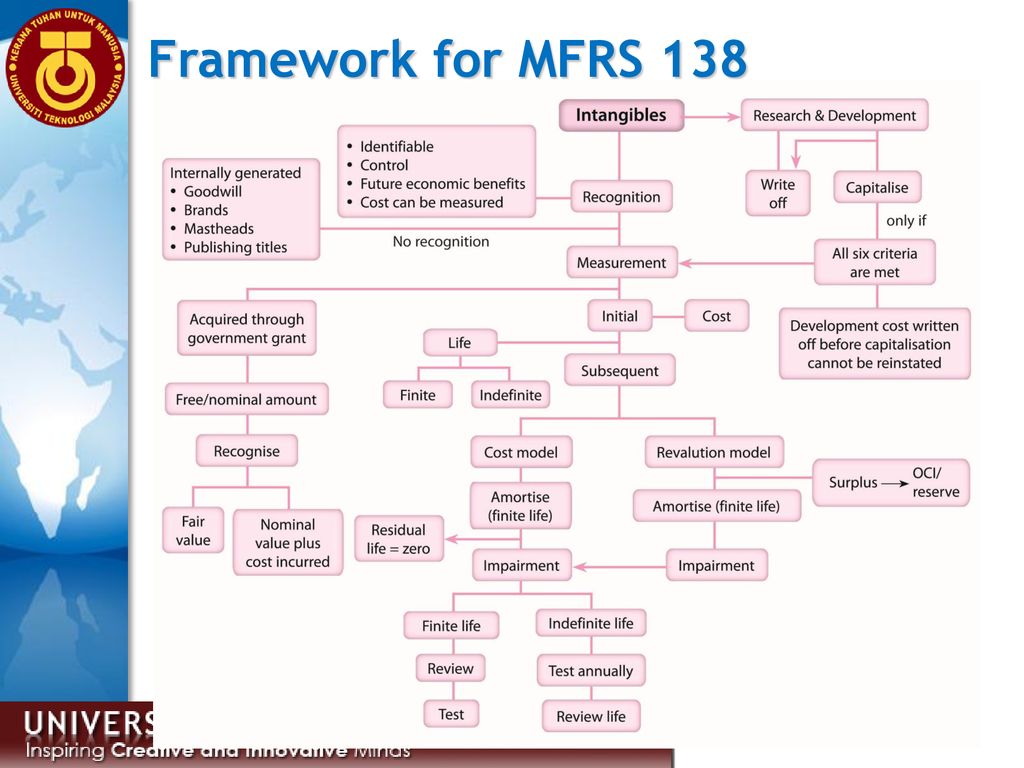

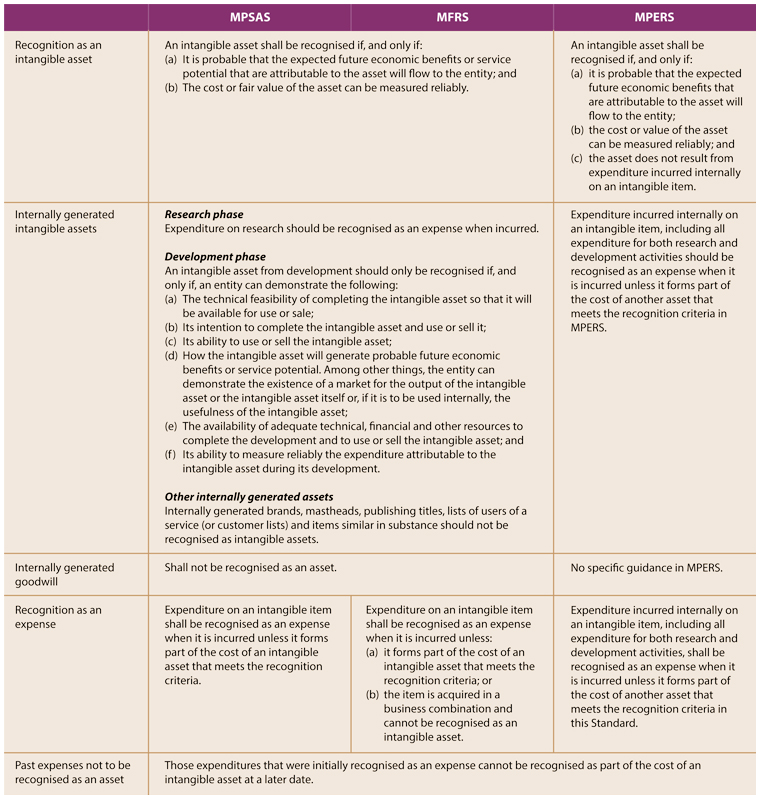

Standard deals generally on intangibles excluding goodwill and including internally generated intangibles classified as research and development.

Mfrs 138 intangible assets recognition criteria. The recognition criteria par. This standard requires an entity to recognise an intangible asset if and only if specified criteria. Intangible assets are identifiable non monetary assets that have no physical substance. Deals only with research and development costs.

By mia mohsen updated. Recognition cont d the recognition criteria in mfrs 138 para 21. The requirements are the same as mfrs in that only development costs that meet the recognition criteria are capitalised masb 4 17. Aasb 138 also requires you to disclose information for each class of your intangible assets distinguishing between intangible assets through internal generation and other intangible assets.

Intangible assets meeting the relevant recognition criteria are initially measured at cost subsequently measured at cost or using the revaluation model and amortised. It is probable that the future economic benefits that are attributable to the asset will flow to the enterprise. Aasb 138 standards accounting auditing as amended taking into account amendments up to aasb 2004 1 amendments to australian accounting standards f2005b00697. No equivalent pers on other intangible assets.

Ias 38 outlines the accounting requirements for intangible assets which are non monetary assets which are without physical substance and identifiable either being separable or arising from contractual or other legal rights. Recognition of subsequent expendituremost subsequent expenditure will amount to maintenance function and note meet recognition criteria and so are. Johntoday i want to explain about mfrs 138intangible assetsso lets start what is intangible assets identifiable non monetary assetno physical substance common. This standard prescribes the accounting treatment for intangible assets that are not dealt with specifically in another standard.

It is the responsibility of each user to comply with. Initial measurement cost trade discount rebates any directly attributable cost of preparing the asset for intended use initial cost. The definition of an intangible assets par. The recognition criteria include a probability recognition criterion s18 4.

Mfrs 138 intangible assets. Mfrs 138 intangible assets covers identification recognition measurement and presentation of intangibles. After recognising an asset as intangible per the factors under aasb 138 you can measure such asset via either a cost or revaluation model. Intangible asset how to calculate initial cost.

Intangible asset abc cc embed powtoon is not liable for any 3rd party content used. And the cost of the asset can be measured reliably meet the definition and recognition criteria recognize as an intangible asset does not meet the above criteria expenditure on this item recognized as. July 26 2015 9 39 p m. Specifics of each model are set out under aasb 138.

My name is mr. 8 17 of ias 38.