Self Assessment System In Malaysia

I obtaining appropriate knowledge ii engaging external tax professionals iii tax audit and investigation and iv record keeping practices.

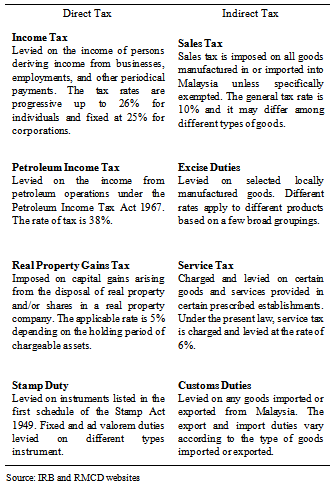

Self assessment system in malaysia. Vol 4 no 6 pages. Malaysia adopts a self assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer. Malaysia s taxes are assessed on a current year basis and are under the self assessment system for all taxpayers. Malaysia adopts the self assessment system where the taxpayer is responsible for computing one s own chargeable income and tax payable as well as making payments of any balance of tax due.

All income accrued in derived from or remitted to malaysia is liable to tax. Prior to 2001 malaysia adopted an official assessment system whereby tax payers are assessed to income tax by the irb based on the tax return filed by them. That said income of any person other than a resident company carrying on the business of banking insurance or sea or air transport derived from sources outside malaysia and received in malaysia. Home e benchmark system for self assessment e benchmark system is an interactive system that aims to speed up the data collection and computation of benchmarks.

Asia pacific tax bulletin issue. 2018 2019 malaysian tax booklet income tax. Monthly salary deductions are made for individuals having employment income or through instalments for individuals having business income. Self assessment system sas tax administration under sas is based on the concept pay self assess and file pay.

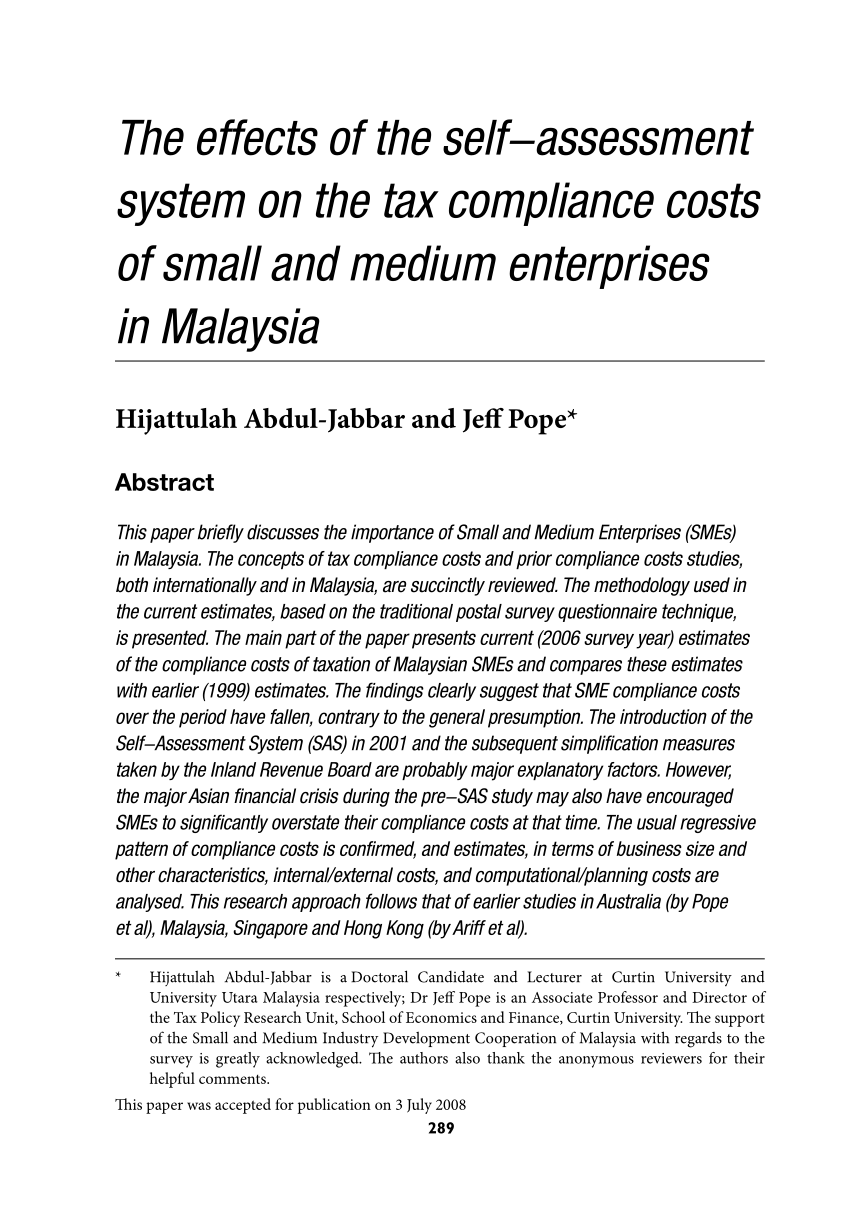

It allows organisation to key in data compute indicators rank performance and benchmark comparisons conveniently through the internet. 2018 2019 malaysian tax booklet 10 returns assessments taxpayers are required to submit their. 01 jun 98 source. Self assessment system sas in malaysia 1160 words 5 pages self assessment system sas in the 1999 budget it was announced that the official assessment system under which taxpayer were assessed to income tax under the income tax act 1967 by the irb based on the tax returns filed by them was to be relpaced by the self assessment system.

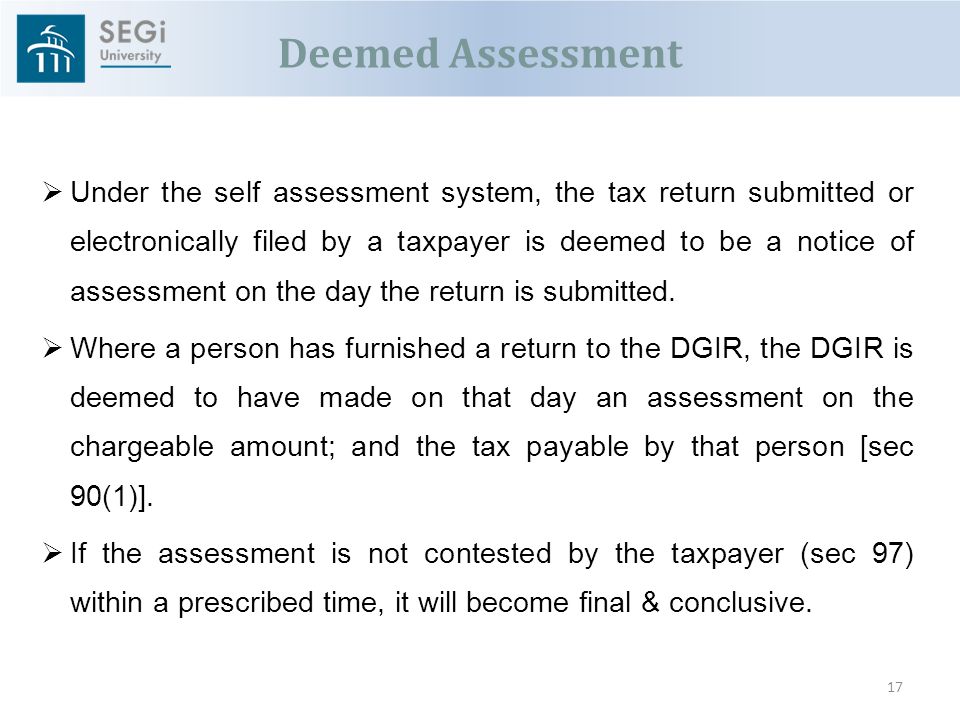

The self assessment system is essentially a process by which taxpayers are required by law to determine the taxable income compute the tax liability and submit their tax returns based on tax laws policy statements and guidelines issued. The government has introduced self assessment system sas in stages commencing with companies from year 2001 and individuals from year 2005 the self assessment system of taxation is a system designed to transfer the responsibility of determining taxable income and computing the related tax liability from. The author describes the features and evaluates the weaknesses of the current assessment system and postulates the requirements for a successful self assessment system. The amount of tax payable for the year must be self computed and the tax return is deemed to be a notice of assessment upon its submission.