What Is Construction Industry Scheme Cis

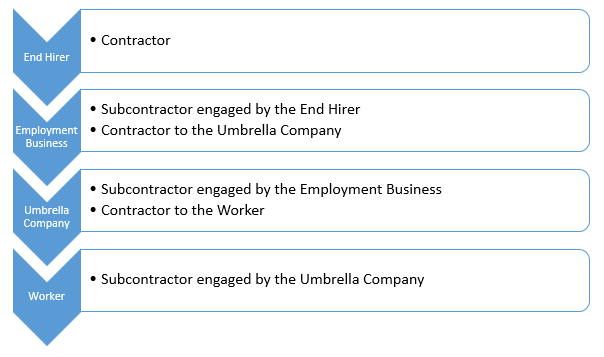

If you are a contractor employing a subcontractor you must deduct the tax for payments and pay them directly to the hmrc.

What is construction industry scheme cis. You re eligible to register for the scheme if you re a self employed construction worker. If you re a full time employee the scheme does not apply to you. We introduced cis to help contractors that wish to provide services under the construction sector or that are already working within cis. The hmrc construction industry scheme was first introduced as a tax evasion prevention measure in 1972 and an updated cis came into effect in 2007.

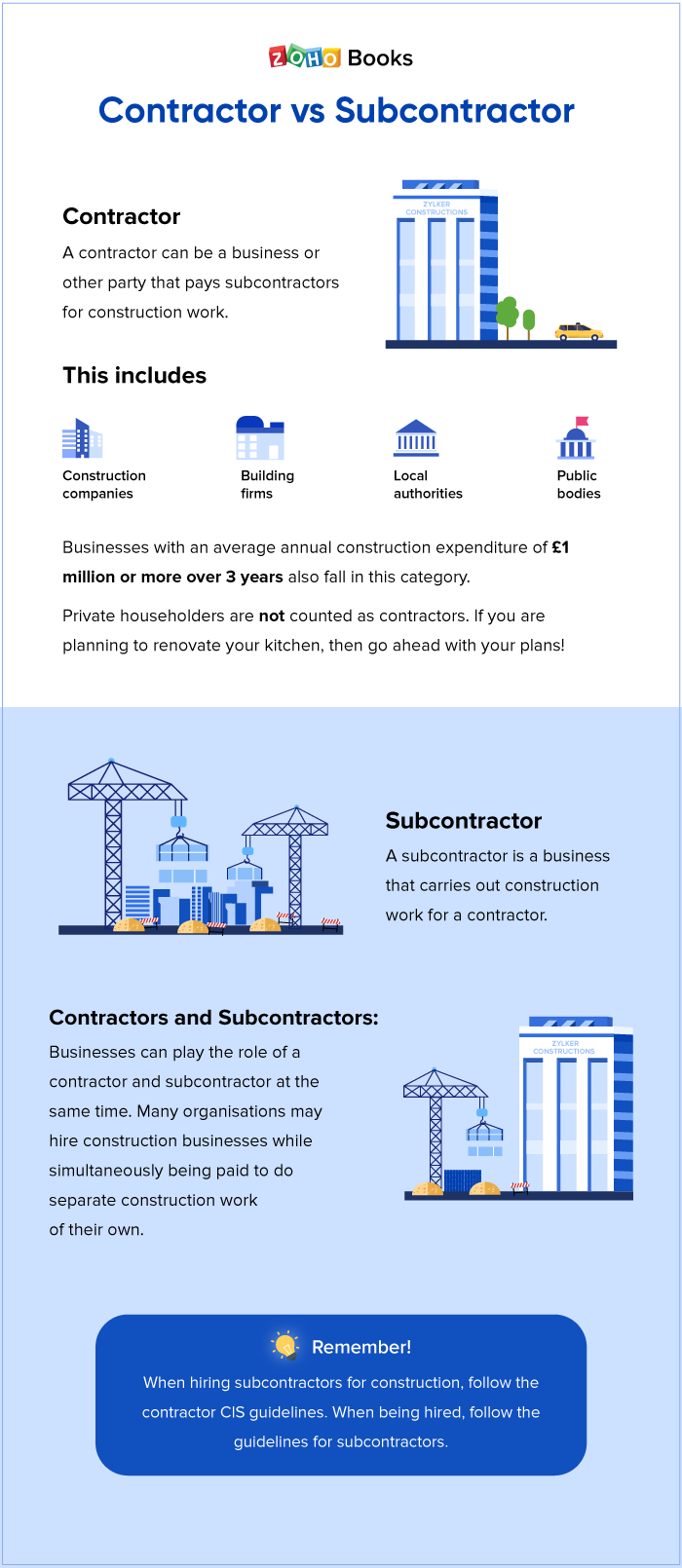

The construction industry scheme cis is used by hmrc to collect income tax from subcontractors in the construction industry. The difference between the two is that the principal activity of mainstream contractors is construction. The key elements of the scheme are. With a number of similarities to paye the construction industry scheme cis is a mandatory withholding tax where either 20 or 30 is deducted from a self employed construction subcontractor s payments and paid directly to hm revenue and customs on their behalf.

The construction industry scheme cis was introduced by the government to set rules about how payments are made for construction workers. 1 introduction to the construction industry scheme cis. Cis is a scheme in the uk issued by hm revenue and customs hmrc for mainstream contractors and deemed contractors in the construction industry.