What Is Construction Industry Scheme

If you re a company partnership or a self employed individual working in the building or construction industry you may have to pay tax under the construction industry scheme cis.

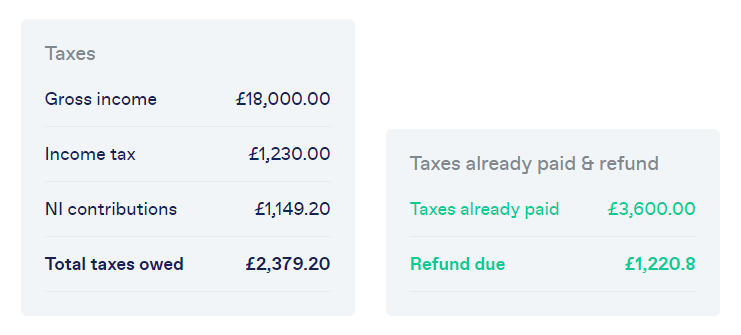

What is construction industry scheme. The scheme is designed to streamline the tax affairs of contractors and subcontractors in the construction industry and also to reduce some of the administrative burden placed on them. The construction industry scheme cis is a set of rules that hmrc insist that contractors must follow when they are engaging subcontractors to provide work in the construction industry. The construction industry scheme cis is used by hmrc to collect income tax from subcontractors in the construction industry. With a number of similarities to paye the construction industry scheme cis is a mandatory withholding tax where either 20 or 30 is deducted from a self employed construction subcontractor s payments and paid directly to hm revenue and customs on their behalf.

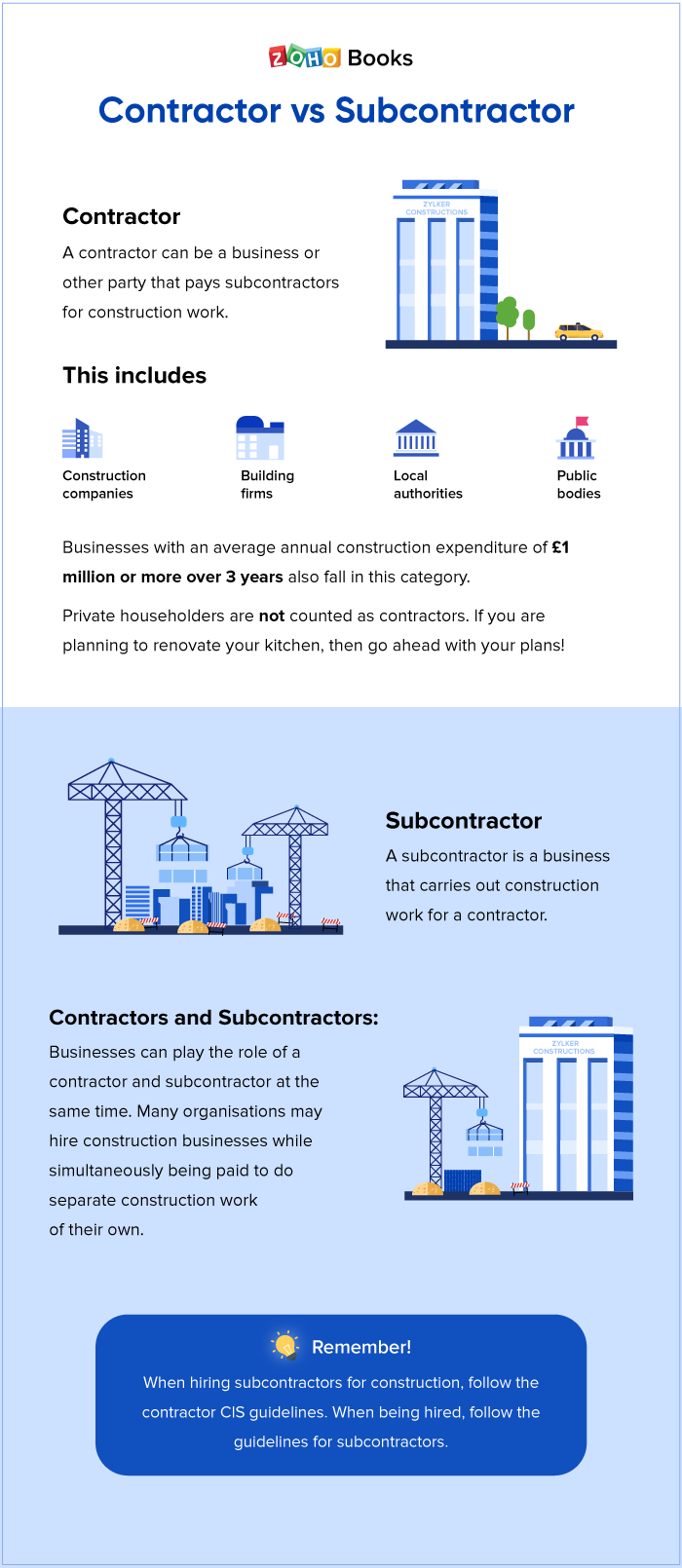

The scheme supports all companies partnerships and self employed individuals who are involved in the construction industry. If you re a full time employee the scheme does not apply to you. You re eligible to register for the scheme if you re a self employed construction worker. A contractor is a business or other concern that pays.

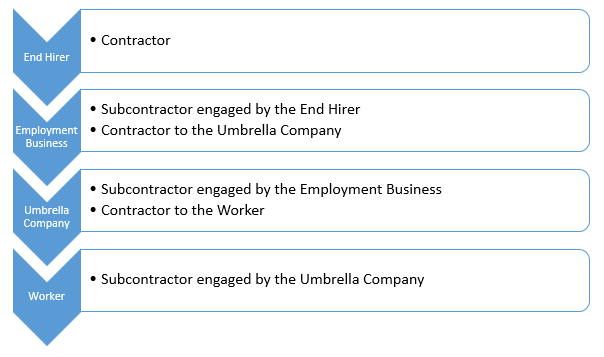

When a contractor does engage a subcontractor the contractor must assess the subcontractor s employment status to determine if the subcontractor is self employed or if they should be employed by them. The cis has nothing to do with payments to staff. The construction industry scheme. The deductions serve as advance payments towards the subcontractor s annual income tax spreading some of their tax liabilities.

Everything from site preparation to decoration to full refurbishments is included in cis remit. Construction operations means any construction contract that includes construction work such as demolition. The construction industry scheme cis is a tax deduction scheme which covers any construction operations undertaken by any entity in the uk and northern ireland including the uk territorial waters. This tax deduction scheme refers to payments made from contractors to subcontractors not.

What is the construction industry scheme. Cis covers the majority of construction work involving buildings. Businesses can be considered contractors subcontractors or both. The terms contractor and subcontractor have special meanings under this scheme.

The purpose of the scheme is for hmrc to raise more revenue. Under the construction industry scheme cis contractors deduct money from a subcontractor s payments and pass it to hm revenue and customs hmrc the deductions count as advance payments.